Products Description

Building Credit with International and US Driver Licenses

Building credit is an important aspect of personal finance that can open up countless opportunities, from getting loans and mortgages to getting great credit card rates. While a driver’s license is not directly related to a credit score, it plays an important role in the overall process of establishing and building credit. In this comprehensive guide, we’ll explore how having a driver’s license can help you build credit, the steps involved, and the broader impact on your financial health.

Understanding Credit Scores

Before diving into the specifics of how a driver’s license can help build credit, it’s crucial to understand what a credit score is. Credit scores are a numerical representation of your creditworthiness, typically ranging from 300 to 850. They’re calculated based on a variety of factors, including:

Payment history (35%): Your record of on-time payments.

Credit utilization (30%): The ratio of your credit card balances to their limits.

Length of credit history (15%): How long your credit accounts have been active.

Types of credit (10%): The various credit accounts you have, such as credit cards, mortgages, and installment loans.

New credit (10%): Recent credit inquiries and newly opened accounts.

A good credit score can allow you to save money in the long run, so it is important to establish and maintain a good credit score.

The Role of a Driver's License in Building Credit

1. Establishing Identity

A driver's license is the primary form of identification. When you apply for credit, lenders require proof of identity to ensure that they are providing loans to the right person. Having a valid driver's license helps streamline this process, making it easier for you to open bank accounts, apply for credit cards, and obtain loans.

2. Opening a Bank Account

To establish a credit history, you typically need a bank account. Most banks require a government-issued ID, such as a driver's license, to open an account. Once you have a checking or savings account, you can manage your finances more effectively. Responsible management, such as keeping a positive balance and avoiding overdrafts, can indirectly support your credit-building efforts.

3. Applying for a Credit Card

Getting a credit card is one of the most direct ways to build credit. When applying, you typically need a driver's license. Credit card companies use this information to verify your identity and assess your creditworthiness. Responsible use of your credit card, such as paying your balance in full each month and making payments on time, will have a positive impact on your credit score.

4. Get a Loan

If you need to apply for a personal loan, auto loan, or mortgage, a driver's license is often required as part of the application process. Lenders want to verify your identity before approving your loan. Responsibly paying off these loans contributes to your credit portfolio and demonstrates your ability to manage different types of credit, which can strengthen your credit profile.

5. Build a Credit History

Every credit account you open affects your credit history. A driver's license connects your identity to your credit activity. This connection is critical because lenders report your payment behavior to credit bureaus, which affects your credit score. A longer, more positive credit history generally leads to a higher credit score.

6. Protect Against Identity Theft

Having a driver's license can help you protect yourself from identity theft. If your driver's license is lost or stolen, reporting it promptly can help prevent your identity from being stolen. Regularly monitoring your credit report for discrepancies can also protect your credit history. Many states offer free credit monitoring services, which can be beneficial.

7. Improve Reputation and Credibility

Lenders generally view people with a valid driver's license as more trustworthy. Having a driver's license can indicate stability, especially if you've had it for a long time. This perception can encourage lenders to extend credit to you on more favorable terms, such as lower interest rates or higher credit limits.

8. Insurance Considerations

Many insurance companies consider your credit score when determining your premiums. Having a driver's license can affect your auto insurance rates, and a good credit score can lower your premiums. This is important because saving money on insurance can free up funds that you can use to pay down existing debt or save for future credit-building efforts.

9. Facilitate Lease Agreements

When renting an apartment or house, landlords often require a driver's license for identification and background checks. A good credit score is often a prerequisite for a lease agreement, and having a driver's license can facilitate the application process. A good credit history can increase your chances of getting your ideal lease.

10. Diversify Your Credit Profile

To build a strong credit profile, it's essential to have a number of different types of credit accounts, such as credit cards, installment loans, and retail accounts. A driver's license can help you get a variety of credit products, allowing you to diversify your credit portfolio over time. This diversity is good for your credit score.

Steps to Building Credit with a Driver’s License

Now that we’ve established the role of a driver’s license in building credit, let’s outline the steps you can take to effectively build your credit profile:

1. Get a driver’s license

If you don’t already have one, get your driver’s license first. This will be a critical step in establishing your identity and accessing a variety of financial products.

2. Open a bank account

Once you get your driver’s license, open a checking and/or savings account. This will help you manage your finances and create a financial history.

3. Apply for a secured credit card

If you’re new to credit, consider applying for a secured credit card. These cards require a cash deposit as your credit limit. Using it responsibly can help you build your credit.

4. Make on-time payments

No matter what type of credit card you use, make your payments on time. Late payments can seriously hurt your credit score.

5. Keep your credit utilization low

Try to keep your credit card balances below 30% of your credit limit. A high utilization rate can negatively impact your score.

6. Diversify your credit portfolio

As you build your credit history, consider diversifying your credit portfolio by adding different types of credit accounts over time.

7. Monitor Your Credit Report

Check your credit report regularly for errors and discrepancies. You can get one free credit report per year from each major credit bureau.

8. Limit New Applications

While building credit is important, avoid applying for too many credit accounts in a short period of time as this can negatively impact your score.

9. Use Credit Responsibly

Establish good habits, such as budgeting and managing debt, to ensure long-term credit building success.

10. Seek Financial Education

Learn about credit management and financial literacy. Understanding how credit works will enable you to make informed decisions.

Conclusion

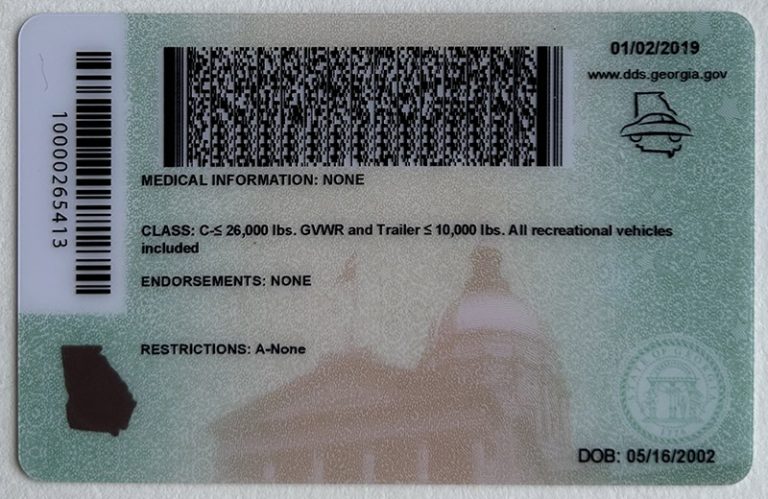

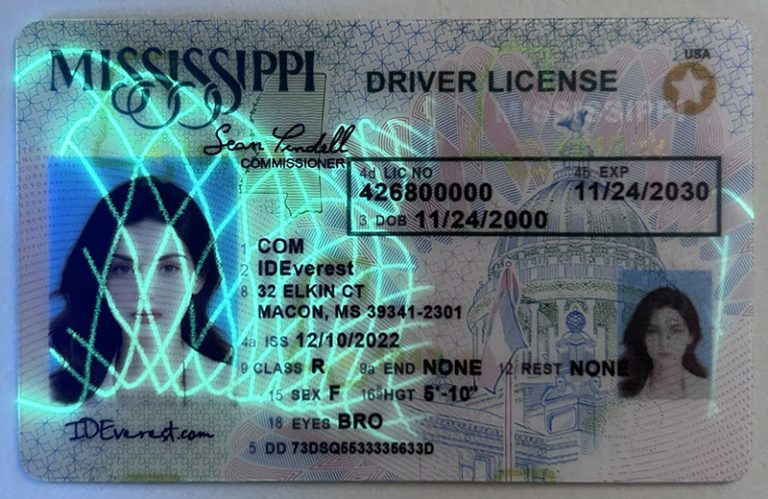

While a driver's license (such as New Mexico fake ID, Georgia fake ID, Mississippi fake ID, and New York fake ID, etc.) is not a credit building tool in and of itself, it plays a vital role in accessing financial products and establishing your identity. By leveraging your driver's license to open bank accounts, apply for credit cards and loans, and maintain responsible financial behavior, you can successfully build your credit profile. Remember, building credit is a marathon, not a sprint; patience and responsible management are the keys to long-term financial health and stability.

Tags:

You like

fake ID features

security features

What should ISS be on a fake I

Utah driver's license